Previous Story

Defi, known as Decentralized finance, also known as distributed ledger technology, refers to a range of technologies that facilitate the management of assets and transactions using a decentralized platform. Defi’s goal is to help solve some of the most pressing problems in finance by enabling developers to create innovative new applications on a global scale.

Decentralized finance is not only about currencies but also about other assets. This can include real estate, financial derivatives, and even digital art. The most common application of this technology is in the financial sector, although there are other applications, such as smart contracts in the consumer goods industry. In this article, you will learn details about Defi technology.

Decentralized finance (Defi) is a term used to describe financial institutions that operate in a decentralized way. This means they do not have a central location, such as an office or building, but are spread worldwide. Decentralized finance is often associated with cryptocurrencies and digital currencies, but it can also be applied to stocks, bonds, and other financial instruments.

The goal of Defi Technology is to create a system that allows people to earn money without having to work for it. This system works like this: You choose a game, install it and start playing. As soon as you complete the game, you will receive a reward in cryptocurrency (BTC or ETH), which can be exchanged for real money at any time.

Defi Technology is a new technology that has been introduced in the field of cryptocurrency. The idea behind it is straightforward, the more you play, the more you earn. Decentralized finance is all finance in which no single entity controls the entire system. Instead, many different entities operate independently of each other, creating their own rules and standards for what is considered legitimate.

Decentralized finance can be used to describe any financial instrument where there is no one entity controlling it all. It could include stocks, bonds, and even cryptocurrencies like Bitcoin or Ethereum. There are several benefits to using decentralized finance over traditional banking systems.

For one thing, there are no middlemen involved meaning you will avoid paying fees for services such as wire transfers or international transfers that banks charge for their services. There’s also less risk involved as you aren’t dealing with one centralized entity taking care of everything for you. Instead, you’re dealing with multiple parties who may or may not agree on what happens next.

DeFi was invented in 2018 by entrepreneurs and Ethereum developers who wanted to open up finance applications from traditional systems. In the DeFi ecosystem, one can build decentralized products on top of the Ethereum blockchain, creating new digital assets outside the traditional financial system.

DeFi allows anyone to invest in projects without intermediaries, such as banks or hedge funds. This eliminates the need for intermediaries who typically charge high fees and have poor customer service. The blockchain technology behind this project allows anyone to start their fund and manage it easily using smart contracts on the Ethereum blockchain. These funds can then be invested in any project approved by its community members through an open voting system built into the blockchain.

The DeFi concept is based on the belief that distributed ledgers will be able to disrupt the financial industry as we know it today by providing cheaper, faster, and more transparent financial products. Blockchain technology has revolutionized how people transact business online without relying on a centralized authority such as banks or governments. This allows people to transact without having to pay fees or wait for approval from an institution.

However, blockchain technology has yet to be fully utilized because large institutions still do not want their data stored on a public ledger where anyone can see it. Defi is a hybrid blockchain that provides the foundation for a new financial system. Defi is an open-source platform that allows developers to build applications on top of it and use its core features, such as smart contracts and DApps, to create new value propositions.

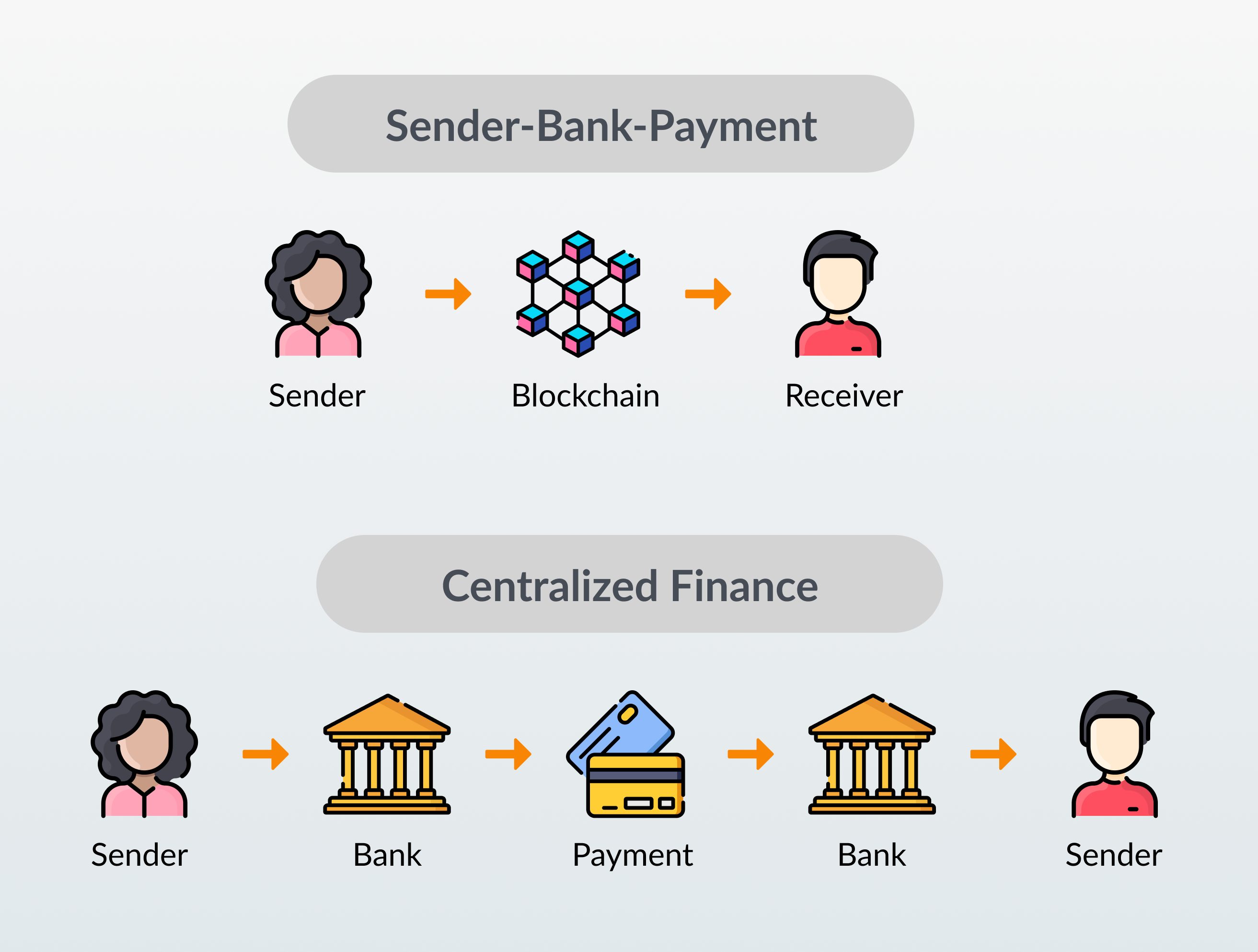

Decentralized finance is a decentralized version of traditional finance. It is based on the idea that there is no central authority to control the economy, as opposed to traditional finance, which relies on centralized authorities such as banks and governments. Decentralized finance is based on peer-to-peer networks where users can trade directly with each other. This system allows for faster transactions and lower costs than traditional financial institutions.

Defi Technology is a blockchain startup that uses cutting-edge technology to create a new trust network for the financial industry. The company was founded by blockchain experts and entrepreneurs who wanted to create new applications that would give users more options and freedom in investing.

The Defi platform allows users to trade digital assets without requiring them to expose their personal information or store funds on third-party platforms. It also allows them to create customized portfolios using advanced algorithms that work with smart contracts. The mechanism of Decentralized finance Defi Technology is based on blockchain technology. Blockchain technology can be used to make transactions more secure and efficient.

It will also help create a decentralized system where all the users are connected and can exchange information without third-party interference. On the other hand, some disadvantages are absent in this type of banking system, such as it’s limited to those with enough financial resources to invest in it or know how to use it properly.

Defi platform that allows users to register on the network and participate in the creation of smart contracts. These smart contracts can be executed by third parties, allowing blockchain technology to be used for business purposes. The main advantage of the Defi system is that it allows you to create smart contracts without knowing anything about programming or even using a computer.

You only need to register on the platform and create your smart contract, which will then be stored on the blockchain. The user can easily sell these tokens and buy them back anytime during their lifetime. This makes Defi very attractive for investors who want to make quick profits without any technical knowledge required.

The technology of Decentralized finance Defi is based on blockchain technology. It is a distributed ledger that can be maintained and updated by thousands of computers worldwide. Blockchain technology is designed to make transactions faster, more secure, and more efficient. Any transaction on a blockchain network is publicly visible and permanent.

Decentralized finance Defi uses this technology by using smart contracts to create a decentralized financial system where users can easily exchange value without having to go through third parties such as banks or other financial institutions. In a world where banks are slowly being replaced by technology, the traditional banking system is facing its biggest challenge.

This challenge is because banks have been using centralized systems that allow them to control the flow of money and services. However, decentralized systems provide an alternative for these banks, allowing them to work with users directly.

The decentralization of finance has led to a new wave of innovation in the industry and numerous new opportunities for consumers and businesses alike. The benefits of Decentralized finance (Defi) Technology include:

Decentralized finance (Defi) technology allows users to access the platform from any location and device. The platform is also accessible 24/7. Defi’s main focus is on providing a platform where people can earn money by playing games, watching videos, and sharing content. This will allow them to relax and enjoy themselves while still earning money through online activities.

The technology allows everyone to access any data they want and share it with the rest of the world. This is possible because all the data is stored in a decentralized database, which means it’s impossible to steal or manipulate it. Blockchain technology allows users to see every transaction made on their platform, which makes it easier for them to make informed decisions. Every transaction will be recorded in an immutable ledger that cannot be faked or altered by anyone.

The blockchain ledger ensures transparency in the system and prevents fraud and corruption. Each transaction is recorded on the ledger and cannot be altered or deleted. Additionally, Decentralized Finance (Defi) technology uses immutable smart contracts. Thus, it provides complete transparency to all parties involved in any transaction or contract.

Technology provides transparency in the financial sector. This means that users can see the real value of a token and how it has changed over time. This is impossible with traditional finance systems, which keep most of the information about transactions secret.

Security is a very important aspect of any financial system. Decentralized finance (Defi) technology gives users full control over their funds, which can be used to send payments and securely make transfers. Security is one of the most important aspects of any system. While blockchain technology has been around since 2008, it only recently gained popularity and has become a hot topic in the past year.

The reason for this sudden interest is simple: Blockchain technology provides a secure way to store data and allows for transaction verification by using encryption and hashing functions on the blockchain. This process makes it nearly impossible for hackers to steal or tamper with data on the blockchain.

Decentralized finance (Defi) technology allows for the interoperability of different systems. Interoperability refers to the ability of two systems, or nodes, to communicate without relying on a third party or intermediary. This means that users can connect their bank accounts to a blockchain account and use that money in the real world. This makes it easy for people who live in different countries or have different currencies to exchange money with each other.

Decentralized finance (Defi) technology can provide this inter-system communication because each currency is issued by its decentralized bank or authority (i.e., no central banks or institutions that issue currencies). This allows users within one system (e.g., Ethereum) to trade with users in another (e.g., Bitcoin).

Decentralized finance technology allows for the creation of smart contracts, which can be programmed to carry out specific tasks or transactions. This means that all transactions can be tracked and verified by the blockchain. It also means no need for any third-party intermediary, such as banks or other financial institutions.

This allows for the creation of new financial applications and services. As a result, there is no need for high fees associated with traditional financial institutions. Defi is programmable and can be used to create any financial instrument. It can be programmed to provide various services, such as payments, loans, equity investments, etc.

With traditional financial institutions, you pay fees on each transaction you make. You pay a fee each time you use it; if you want to make an online purchase, you still have to pay a fee because they use an intermediary like PayPal or Square to process payments. With decentralized finance technology, however, all transactions are processed directly between users without any third-party involvement.

This means there are no additional fees associated with using decentralized finance technology compared with traditional methods. Defi is not just another cryptocurrency but also a decentralized platform that provides users with low fees compared to other blockchain platforms. This makes it an ideal solution for anyone trying to cut down on transaction costs.

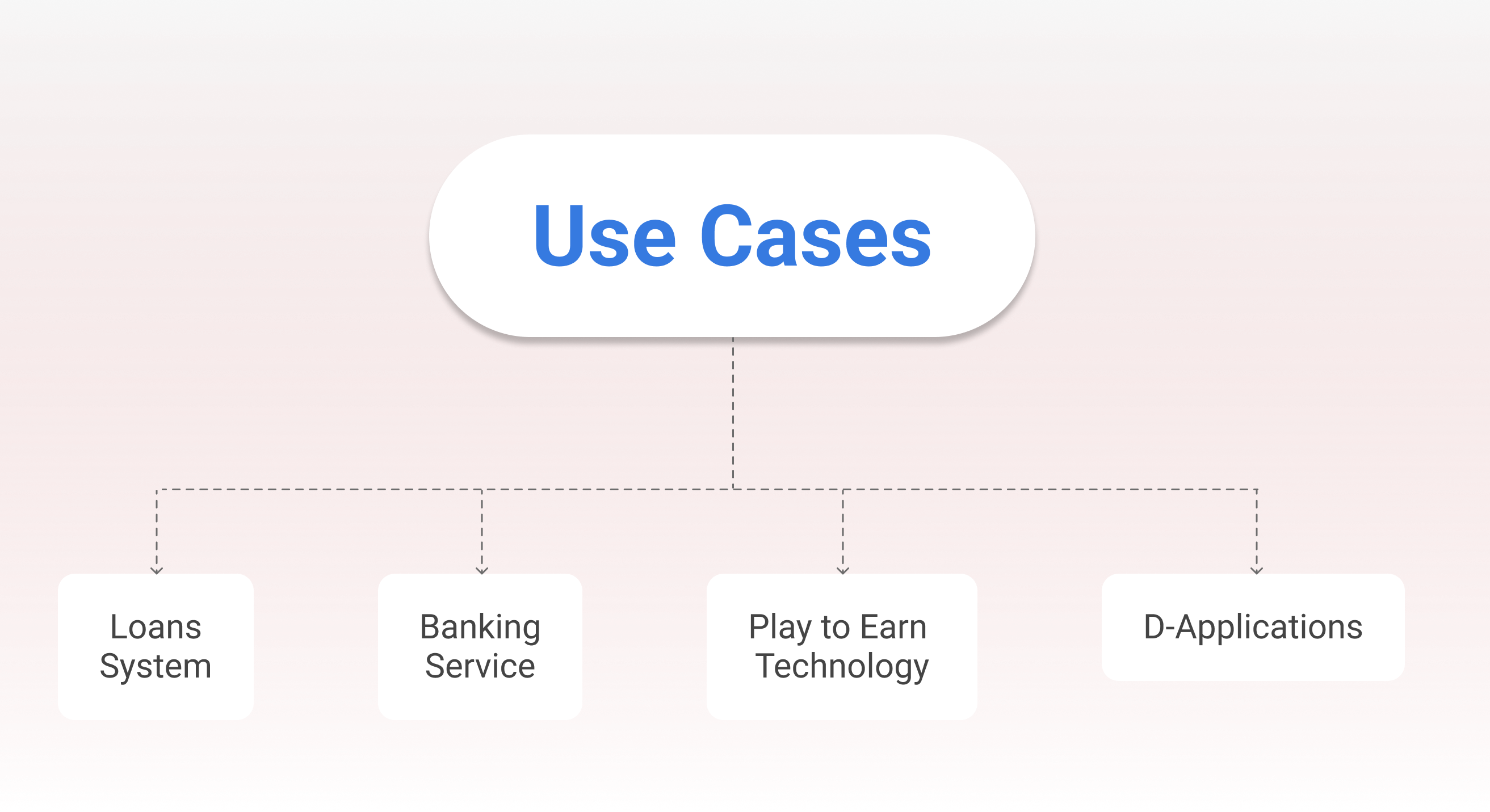

Defi Technology has become a strong financial technology company that has provided high-quality products and services to the banking industry. The company can help the traditional banking industry stay competitive in the modern world. Defi Technology provides many products and services to help people manage their finances more easily. These include:

This system allows users to access loans from any bank or institution. It also allows them to track their loans online, so they know what each payment will be for at any given time. The system also allows users to make payments on their loans quickly without needing help from anyone else. Defi Technology is a complete system of loans and methods for personal and business purposes. The system provides you with all the information about your financial situation, repayment conditions, and other loan agreement details.

Defi Technology offers its clients a full range of banking services, including checking accounts and debit cards, as well as credit cards and debit cards for those who need extra funding for major purchases like cars or homes. The company’s goal is to make it easier for people with low incomes or bad credit ratings to access financial products they otherwise wouldn’t be able to access.

Defi Technology provides a convenient online service that allows you to view all your loans at once. You can also see how much money you have in your account, how much money is still left on your loan, and how much interest is due on each loan.

The company plans to implement the Play-to-Earn (P2E) model to monetize its users’ data. Users who provide their data will be rewarded in DEFI tokens when an advertiser wants their data, e.g., when an advertiser wants information about someone’s age or location.

The advertiser will purchase advertising space on the network using these tokens and then pay users who provide them with their data with these tokens as well. This way, every transaction on the network will be transparent and traceable because all transactions are recorded on blockchain technology, which allows users to see how much each other person has earned from providing personal data for advertisers.

The Defi Technology platform is built on top of the Ethereum protocol. It utilizes smart contracts to create new decentralized applications (Dapps) that can be built upon it. These Dapps will run on a decentralized framework where users can interact with each other through self-executing smart contracts. This enables users to create, manage and trade cryptocurrencies without relying on centralized third parties.

The platform also offers users access to various services such as exchange, wallet creation, decentralized application development, and many more. Defi Technology creates a safe environment for content creators who want to earn money without having any middlemen or third-party involvement in their business operations.

By allowing users to create their wallets, earn rewards for unique content created by them, and also by allowing them to trade cryptocurrencies directly through the platform itself, Defi Technology has created a new way of doing things while making sure that all transactions are safe and secure at all times.

Defi is a blockchain project aiming to revolutionize how we use technology. Defi uses its cryptocurrency for peer-to-peer payments, which has many applications in various industries. Defi Technology is the world’s first blockchain-based platform that allows content creators to monetize their digital assets. Defi Technology allows content creators to earn revenue from the sale of their digital assets while offering them the opportunity to earn rewards and be rewarded for the value they create.

© 2025 by Speed1 INC.