Previous Story

TARO, a new protocol proposal from Lightning Labs for Bitcoin and the Lightning Network, aims to expand the network’s use cases. The business has made several Bitcoin Improvement Proposals (BIPs) available and is seeking community input on the suggested layout.

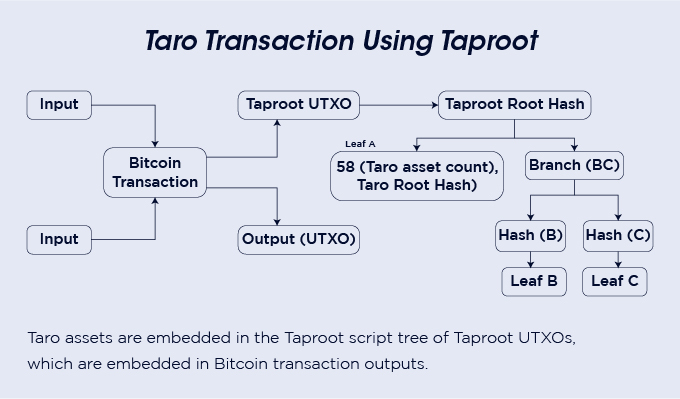

The goal of TARO is to make it possible for non-fungible assets, such as valuables and collectibles, to be issued on Bitcoin and transferred to Lightning confidentially and safely without overburdening the blockchain. It intends to use Taproot, the most recent protocol improvement, to do this.

TARO is a brand-new Taproot-powered protocol that lets the users create assets on the blockchain of bitcoin that can then be sent through the Lightning Network for quick, high-volume transactions at a minimal cost. At its heart, TARO uses Lightning’s speed, scalability, and lesser costs, along with the security and dependability of the bitcoin network.

TARO may provide assets on Bitcoin and Lightning in a more secure and scalable way by using a Taproot-centered design. TARO assets may be put into Lightning Network channels, where nodes can provide atomic Bitcoin to TARO asset conversions. As a result, the TARO assets may communicate with the more extensive Lightning Network, maximizing its use and bolstering its network effects.

To enable quick, effective, private retrieval and modifications to the witness/transaction data and to demonstrate legitimate conservation/non-inflation, TARO utilizes a Merkle-Sum Tree and a Sparse-Merkle Tree. When put into a channel on the Lightning Network, assets can be moved via on-chain transactions.

The major features of TARO that make it worthy of hype are enlisted here,

Multiple reasons have led Taproot to be the base for TARO, and all the more reasons that add to it are its amazing benefits. Here are the major ones,

The most significant aspect of the upgrade is how Taproot affects privacy. Schnorr signatures and key aggregation make multi-signature contracts seem identical to single-signature contracts, giving all Taproot users privacy. Taproot makes it hard to determine which transactions produce Lightning channels since the Lightning Network relies on 2-of-2 multi-sig. Through the incorporation of MAST, Taproot also brought forth considerable privacy advantages. Only the script used needs to be disclosed when spending bitcoin from a Taproot output; other potential scripts that may have unlocked the bitcoin do not need to be disclosed. Most Taproot users will probably select the pay-to-public-key option, which enables them to keep any backup plans they may have secret.

Most Taproot (P2TR) outputs take up somewhat less blockchain space than P2PKH outputs but slightly more than P2WPKH outputs. This is mainly because P2TR outputs lock bitcoin directly to a public key rather than the public key’s hash. Since public keys require more storage space than public key hashes, transmitting to Taproot outputs is a little more expensive. The public key in the scriptPubKey does not need to be included in the Script Witness, making spending Taproot outputs substantially less expensive. Taproot also specified the encoding strategy for Schnorr public keys and signatures to save even more money, making them shorter than their ECDSA equivalents.

TARO Protocol is an open-source protocol for the transfer of any digital assets. The protocol provides a secure and decentralized platform to trade, manage and store digital assets. It also allows users to create their tokens and use them differently. TARO Protocol is designed for anyone who wants to make an asset exchange where they can trade or invest in different assets. TARO Protocol was created by a team of developers with over ten years of experience developing e-commerce solutions, including online shops and payment systems. The company has strong ties with the blockchain community, having worked with notable projects like Bitcoin.

TARO is a digital asset platform that provides a solution for people to buy and sell digital assets. The exchange platform is operated by TARO, a company that aims to create a blockchain-based system to exchange virtual currencies. Digital assets are any item that has value based on its existence in virtual spaces or on the Internet. The TARO project aims to provide an exchange platform where users can freely trade with each other in the form of digital assets. To achieve this goal, they have created an entire ecosystem that includes developers who will develop applications that use blockchain technology.

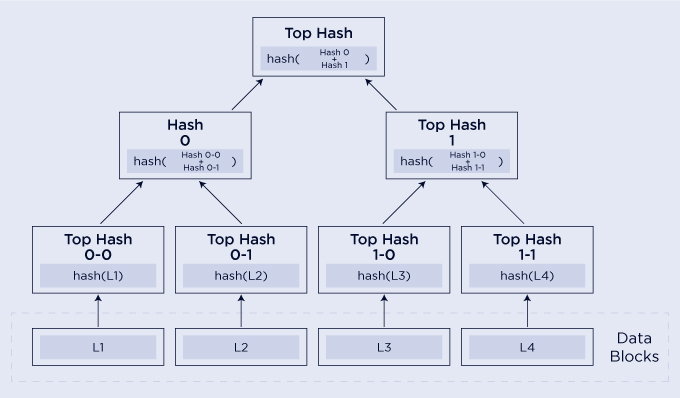

The TARO protocol is designed to work with any cryptocurrency. It’s a peer-to-peer network where users can connect and exchange data without going through a central authority such as a bank or credit card company. The role of Merkle trees in the TARO protocol is to ensure that every transaction is recorded on the blockchain. Since each block contains a hash of all previous blocks, it is impossible to change any data without changing all previous blocks.

This ensures that both parties involved in a transaction have a copy of the same information. In other words, no one can fake their way into being paid or charged for something they haven’t done. The TARO protocol uses Merkle Trees to verify the integrity of blockchain transactions. A Merkle Tree is a collection of hashes and small chunks of data that can be used to prove the integrity of more extensive data blocks. The TARO protocol uses these hashes to verify the validity of blockchain transactions, which is why it’s called Merkle Tree Proofs.

TARO uses a Merkle Tree to keep the content of the blockchain. The Merkle tree is an efficient way to store content in a distributed system. It allows for efficient verification and retrieval of data, in addition to allowing for fast propagation of information through the network. Merkle trees are used to verify that a piece of data has not been tampered with and that the data has been delivered correctly across all nodes in the network. Using the Merkle tree, each node can independently verify whether or not it has received all parts of the original message. Merkle trees are also used in software development to store information about individual objects or files on a computer system.

TARO is a token that can be used to power decentralized applications (DApps) built on the Taro network. TARO is an open-source project, meaning anyone can contribute to the codebase and develop new features for the network. The platform has been designed to allow people to build their apps with minimal coding knowledge or technical skills. TARO has its blockchain, which is natively based on Bitcoin’s scripting language, and it also supports zero-knowledge proofs.

TARO is the first and only platform that allows you to earn tokens from transactions on the Bitcoin network. TARO is a blockchain-based platform that enables users to make tokens from trades on the Bitcoin network. It also provides a suite of services, including a wallet, a trading bot, an exchange, and more. TARO Network is a decentralized protocol built on top of Ethereum and IPFS. It aims to be a marketplace for decentralized applications (DApps) through which developers can create smart contracts, collect fees, and transparently distribute their assets.

On a technical level, TARO is a perfect example of how a non-profit foundation can leverage the power of blockchain technology to achieve its mission. TARO’s long-term goal is to make crypto investing easy, accessible, and profitable for everyone. To do that, they need to provide an investment product that stands out from the crowd.

TARO is one such product. It’s an exchange-traded fund (ETF) that invests in cryptocurrencies and uses the same principles as traditional ETFs but with additional benefits.

TARO is a blockchain company that provides a suite of services that facilitates the use of digital assets. TARO’s core offering is an automated market maker (AMM) service, which allows users to trade digital assets across multiple exchanges and wallets.

The TARO token is used to pay transaction fees on the TARO network and to access certain features and tools within the ecosystem. TARO’s AMM is operated by several third-party market makers who execute buy and sell orders for the benefit of TARO token holders. These market makers are incentivized to generate liquidity to increase their profit margins while ensuring enough buyers and sellers are available to meet client demand.

TARO is a decentralized automated advisor, which means it takes care of everything for you. It can be used to trade the most popular cryptocurrencies on exchanges like Binance, Coinbase, and Kraken. TARO can also be used to create your custom cryptocurrency trading bot on the Lightning Network. You do not need programming skills or coding knowledge to use TARO’s built-in options or create your custom bots.

The application is currently being developed by a team of developers and marketers worldwide. The main goal is to help people make money using their computer power rather than other investment forms. TARO is a decentralized exchange that uses innovative contract technology to enable the instant trading of traditional assets. TARO utilizes the Lightning Network (LN) as its settlement layer, allowing real-time transactions on a censorship-resistant network.

The TARO core team consists of experienced technologists who have worked on projects like Bitshares and Ethereum. They have a strong focus on user experience and design, which has led them to use open-source software for their platform. Lightning Network is a second-layer cryptocurrency payment protocol built on the Bitcoin blockchain. It allows instant, low-fee payments from one Bitcoin user to another anywhere in the world.

TARO is an open-source payment network that runs in parallel with Lightning Network. TARI is a bridge between Lightning Network and Ethereum Classic (ETC), which was created after TARI’s inception. Because of this, the main focus of TARI development is on the Ethereum Classic (ETC) side of things.

TARO Network is a decentralized network that aims to provide users with a secure, high-speed, and low-fee payment solution. The TARO Network is built on the Ethereum blockchain and uses its innovative contract technology. Conversely, TARO is a second-layer protocol that uses Bitcoin’s blockchain to move data. Lightning Network is a second-layer payment protocol that enables instant and near-zero cost transactions on the Bitcoin blockchain. It’s designed to become a decentralized network of payment channels that can process thousands of transactions per second. This open-source technology has been under development for almost three years, with many companies developing solutions.

The TARO Network has developed an open-source protocol called TARO Protocol, which is compatible with any blockchain network. The first use case of the TARO Protocol will be in providing instant transactions for merchants and consumers across different blockchains. Merchants can accept payments from consumers in any currency supported by the TARO Protocol, while consumers can send payments to merchants in any currency supported by the protocol. The goal of TARO Network is to make digital currencies more accessible and easier for everyone to use. It wants to create a better user experience for both consumers and businesses by providing them with a faster way of making purchases, paying bills, or transferring funds between each other.

TARO Protocol is a decentralized and transparent platform that uses blockchain technology and smart contracts to allow people to buy, sell, rent, and trade digital assets. TARO Protocol is an Ethereum-based token that powers the entire system. The primary function of the TARO Protocol is to create a marketplace where any digital asset can be traded without borders or restrictions. The TARO Protocol platform will be powered by its tokens, which can be used for all transactions on the forum.

TARO Protocol aims to create a peer-to-peer (P2P) trading network where buyers and sellers can connect their accounts using smart contracts. The TARO Protocol’s goal is to become a one-stop shop for all types of digital assets, including cryptocurrencies such as Bitcoin. The Asset Management feature allows you to track and manage your accounts and assets. You can create custom portfolios based on different investments, such as stocks, bonds, cash, mutual funds, and ETFs. You can also create custom portfolios based on the criteria you want. For example, if you’re going to track your stock portfolio according to growth potential or value, then use a Growth Stock Portfolio. Or, if you prefer stability in your investments and are looking for value instead of growth, use a Value Stock Portfolio.

You can also choose prebuilt portfolios that match specific criteria such as risk level or expected return and customize them further by adding/removing individual holdings from the portfolio. Asset management is a process of investing to achieve a target return. Asset management aims to maximize the return on the investment while minimizing the risk. Asset managers have different strategies for achieving these goals. They may take positions in individual securities or portfolios or manage funds that invest in stocks and bonds.

Asset management generally involves selecting appropriate investments for an investor’s risk tolerance and time horizon. In addition, factors such as liquidity and cost affect how much an investor can get for his money when he wants to sell his investments.

In large portfolios, dozens or even hundreds of securities are available for purchase by an investor. Making informed decisions about which ones should be purchased can be difficult because there are many factors involved in this process. Since each security has unique characteristics, an asset manager must analyze each one carefully before deciding whether or not his portfolio will purchase it.

Asset Issue & Transfer service is a feature that allows you to issue new assets and transfer existing ones. This is the process of creating new tokens and distributing them to the holders of your old assets. You can also share your assets as tokens with another person.

Asset issue is the process of creating a new asset.

Once an asset is issued and transferred to a client, it becomes available for use. Asset transfer can be used to move assets between different accounts. For example, if you want to transfer money into your business account, you need to first transfer the funds from your business account into your account.

Once you have entered all of these details, click create. The investment is now available in your account and for use by any user within your organization who has received permission from their supervisor to use it.

Asset issue and transfer are the two most essential activities in a financial institution. Asset management is a crucial part of the asset issue and transfer process. A good asset manager can help a financial institution to make better investment decisions, improve cost competitiveness, reduce risks and achieve sustainable growth.

An asset manager is responsible for the effective management of assets following the rules and regulations of their organization. They must ensure that all purchases are properly managed and tracked through accounting systems. For example, they should be familiar with accounting standards such as IFRSs, GAAPs, etc., which can help them understand how assets should be valued at different points in time based on market conditions and other factors like economic indicators or interest rates, etc., The asset manager should also be able to analyze financial statements for any irregularities or misstatements to prevent fraud from happening at any level within the organization.

The Asset Issuance & Transfer command is used for creating new Asset tokens or transferring an existing one. The management requires you to specify if you want to issue a new asset or share an existing one, its name, amount, token type (ERC20 or ERC721), and whether it needs approval from other users before being issued.

The term “asset management” has been used in two different ways. One usage refers to the broader concept of investing or managing investments. Another usage refers to a specific sub-discipline within investment management that addresses individual investments. An asset Market is where the trading of assets, commodities, and financial instruments occurs. It includes all the trading activities that happen in the financial markets. The Asset Exchange is a global platform where different financial instruments are traded. Each asset has an entry, and exit price called the bid and ask prices. The Asset Price is determined by supply and demand, which means that it depends on the amount of demand for an asset and the collection of investment.

TARO Asset Exchange is a decentralized asset trading platform that enables users to buy and sell digital assets. The exchange will be built on the NEO blockchain, which is one of the most popular platforms in the cryptocurrency world. The TARO Asset Exchange will be a peer-to-peer platform where users can connect directly with each other to buy and sell digital assets without any intermediary involved. This means that there are no fees associated with buying or selling these assets on the exchange and no middlemen taking a cut of the profits.

Asset management on TARO is a long-term investment project that aims to solve the problem of asset allocation in the crypto world. The project’s main objective is to provide a platform for investors who want to diversify their portfolios. The second objective of this project is to create open-source software with all necessary asset management features. This project’s third objective is to improve asset management’s efficiency and make it more convenient for users.

Asset Exchange will be developed as a hybrid blockchain platform combining public and private chain technology. This combination will provide all necessary functions for asset management and allow everyone to participate in it without any restrictions or restrictions, including any governmental bodies or organizations! The TARO Asset Exchange will also offer 24/7 customer service and support, which is essential to any successful business. The team behind this project is committed to providing excellent customer service, especially since so many people are involved in every project stage from start to finish.

The TARO Asset Exchange will have its native token, called TARO, explicitly created for this platform. This token can be used for almost everything related to trading on the exchange, including buying and selling cryptocurrencies and paying for services like withdrawals and deposits.

TARO protocol is a decentralized token exchange that utilizes the power of blockchain technology to enable the trading of cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. The platform is designed to be a global marketplace for digital assets to provide users with a secure environment for trading. TARO uses an advanced security model which features multiple layers of encryption and authentication. The platform aims to provide users with an easy-to-use experience while maintaining security and privacy. It will also allow them access to some of the most popular cryptocurrencies in the industry, such as Bitcoin, Ethereum, and Litecoin.

1. What is TARO?

TARO is a protocol that enables decentralized applications (DApps) to be built on top of the Ethereum network. It uses smart contracts as the primary vehicle for exchanging value between users and DApps.

2. What are tokens?

Tokenized assets are represented by unique digital assets (tokens) that can be traded and exchanged on the platform. Each ticket represents a real-world asset or other digital good. Tokens usually have a fixed supply, which makes them subject to price volatility.

3. How does TARO work?

TARO works by allowing users to lock up funds in smart contracts, which can later be released if certain conditions are met. This means that locking up your money in intelligent contracts becomes easy for you to participate in DApps without worrying about losing your tokens or having them stolen by hackers.

4. How can you get TARO tokens?

The TARO token is not a tradable security but the fuel that powers the platform. The fuel price is based on market demand, with a supply limited by a combination of factors, including technology, team size, and complexity of the project being built.

5. Why does the TARO protocol have its token?

The TARO token (TARO) has been designed to provide value to all participants in the ecosystem. It is a utility token that can be used for any purpose within the TARO ecosystem, including payments for services provided by nodes and stakers on the network. The ticket can also be used to pay fees on transactions in the network or other tokens on exchanges. In addition, holding TARO makes it easier for you to participate in the network, as you can vote on issues related to your application using your stake instead of paying fees.

6. How is TARO different from other tokens?

TARO is not a cryptocurrency but a token that can be used to purchase goods and services. Tokens are digital files that represent financial value and are usually created by a company or an organization. The most well-known token is Bitcoin (BTC), which was built in 2009 and became the first decentralized cryptocurrency. TARO will become an efficient way to make payments in real life, just like Bitcoin or Ether (ETH) have done so far.

7. What is Lightning Network?

The protocol works by creating a network of payment channels that allow users to conduct off-chain transactions with each other. The network has been built on the Bitcoin blockchain, but it can also be used with other cryptocurrencies, such as Litecoin and Ether. The goal of the Lightning Network is to provide a decentralized solution for Bitcoin users who want to make instant payments without using the Bitcoin blockchain itself.

© 2025 by Speed1 INC.