Previous Story

Bitcoin is an open-source, global, peer-to-peer cryptocurrency and payment system. It was invented by an unknown person or group of people under Satoshi Nakamoto in 2009. The supply of Bitcoin is finite in nature, the market will have a maximum of 21 million available in the coming future.

The emergence of Bitcoin was to decentralize the authority where no intermediaries are involved in processing & completing the transactions; all you need to have is internet access & crypto wallet.

Essentially Bitcoin was used to buy things, but due to its finite nature, people now prefer to invest in it instead of using it as a currency. Satoshi took inspiration from the cryptography community to build the decentralized system.

Bitcoin has grown significantly throughout its history, making it a practical way to store money online and offline. Around the middle of 2010, some businesses began accepting Bitcoin along with the traditional fiat currency. It was the start of Bitcoin’s history.

Bitcoin has been controversial since its inception, with various critics noting concerns, including the lack of regulation, the volatility of prices, and the use of Bitcoin for non-traditional activities.

The peer-to-peer electronic payment system was created to be open, censorship-resistant, and cryptographically secure. The real draw for Bitcoin’s early users was in its promise to wrest power away from banks and financial institutions and give it to the people, using the power of blockchain technology to establish an irreversible ledger preventing double-spending.

As the 2008 financial crisis spread globally, this was highly alluring. In what has been called the most significant financial crisis since the Great Depression, the U.S. stock market lost $7.4 billion in value in just 11 months, and the world economy contracted by an estimated US$2 trillion.

In the case of Bitcoin, the creator(s) goes by the alias Satoshi Nakamoto. Satoshi Nakamoto’s identity is unknown to the public. The first critical public investigation led to Dorian Nakamoto becoming Bitcoin’s developer, but he continues denying it.

It signed up for the domain name Bitcoin.org on January 4, 2008. Later that year, on October 31, Satoshi Nakamoto posted a link to a document called Bitcoin: A Peer-to-Peer Electronic Cash System on a cryptography mailing list.

This paper showed how to build a peer-to-peer network-based “system for electronic transactions without relying on trust.” On January 3, 2009, Satoshi Nakamoto mined the genesis block, also called block zero, which gave him 50 Bitcoins. It started the Bitcoin network.

According to its Q1 2022 earnings release, the US-based software business MicroStrategy (MSTR) is the largest publicly traded corporate owner of Bitcoin in the world, with holdings of roughly 129,218 BTC. MicroStrategy held approximately $3 billion worth of BTC as of July 22, 2022. As well to this, Tesla (TSLA) owns Bitcoin as well.

The information held in the blocks on the blockchain is encrypted by Bitcoin using the SHA-256 hashing algorithm. A 256-bit hexadecimal integer is needed to encrypt transaction data stored in a partnership. It can find all transactional information and details related to blocks before that block in that number.

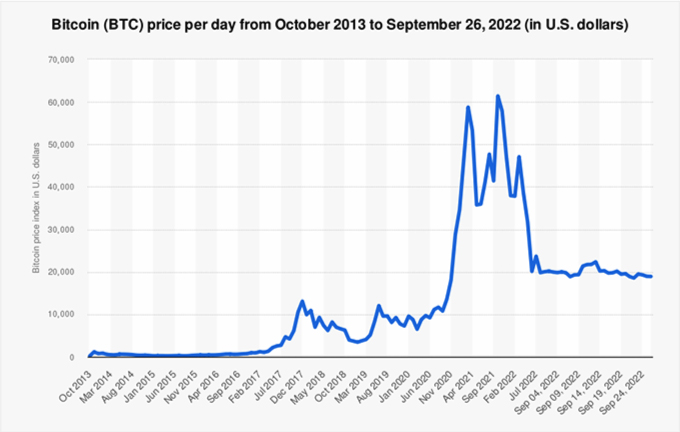

Bitcoin started trading in July 2010 at US$0.0008 and, by the end of the month, had increased to US$0.08. After that, the cryptocurrency’s performance was comparatively flat. It gradually increased to the US$10 level before surging to US$250 in April 2013.

The final closing price for Bitcoin (BTC) on December 31, 2012, was $13.45. It represents an increase of 185% over the previous year. According to the most recent cost, the total amount is $19,025.92.

There was no price for Bitcoin at its launch. In the Bitcoin white paper, the originator, known pseudonymously as Satoshi Nakamoto, explains how the new technology works.

You may wonder, “how much was Bitcoin in 2009,” the precise year it established the popular cryptocurrency? For most of 2009, Bitcoin was worth less than one cent (USD). Though Bitcoin currently trades at over $9,300 per coin, it did not initially sell at such a high value.

The first time BTC and the U.S. dollar were equal was in February 2011. BTC reached $10 on the Mt. Gox exchange months later and quickly soared to $30. From about $0.30 at the beginning of the year, Bitcoin has risen 100 times.

In 2021, Bitcoin’s value kept going up. In November, it hit a new all-time high of U.S. $68,649.05, a 98.82% increase from January. The digital asset lost some value by the end of the year, finishing at US$47,897.16. However, this is a 62 percent increase from the year before.

Investors were willing to take risks, and Tesla’s (NASDAQ: TSLA) announcement that it had bought $1.5 billion in Bitcoin were two big reasons for the rise in 2021. Things got even more complicated when Tesla said it would start accepting Bitcoin as payment for its electric cars.

Bitcoin mining is the process of confirming Bitcoin transactions and creating new Bitcoins through the competition for block rewards. The block reward is 25 Bitcoins for each block mined.

It takes about 10 minutes to find a new block using conventional computing resources. Bitcoin mining has this name because it resembles the mining of other commodities: it requires exertion and time to locate, assess, and exploit natural resources.

Bitcoin mining can take place using a wide range of hardware and software. In the early days of Bitcoin, personal computers could actively mine the cryptocurrency.

But as it gained popularity, more miners joined the network, decreasing the likelihood of being the one to figure out the hash. If your personal computer has modern hardware, you can still use it to mine, but the possibility of successfully solving a hash on your own is quite slim.

It is because you are up against a network of miners that produce 220 billion hashes (220 quintillion hashes) each second.

Machines, called Application Specific Integrated Circuits (ASICs), have been built specifically for mining—can generate around 255 trillion hashes per second. However, a machine with the newest hardware can hash at a rate of about 100 mega hashes per second (100 million).

Bitcoin’s journey has been one of significant growth and changes over the last several years. Here are a few notable events in Bitcoin’s history:

It is widely believed that this day—notable to many Bitcoiners—marks the day that Bitcoin was formally “born.” Satoshi Nakamoto describes a digital currency that operates independently of conventional financial systems in the first nine pages of the white paper, “Bitcoin – A peer-to-peer electronic cash system.” It sent out the form via a cyberpunk mailing list in November 2008.

Eleven sections in the paper explain how Bitcoin works in detail. The article discussed a few topics: transactions, proof-of-work, easier payment verification, and privacy. As the first block on the blockchain, the Genesis Block was created on January 3, 2009, by Nakamoto.

The first Bitcoin transaction was conducted three days after Bitcoin’s core software was released. Satoshi Nakamoto sent one hundred Bitcoins to Hal Finney, a renowned Bitcoin pioneer.

In the spring of 2011, Bitcoin’s most prominent merchant services provider released the first mobile wallet. The “Bitcoin Bowl” came to be when BitPay signed some of Bitcoin’s most important contracts, such as with WordPress, Newegg, and the St. Petersburg College Football Bowl. Over 60,000 of the more than 100,000 stores accept Bitcoin worldwide.

Over the first four years, Bitcoin’s value in U.S. dollars increased. By November 2013, it had gone from US$125 in September to over US$1,100. It is because of several things, like the entry of Chinese exchanges and miners, as well as the questionable price management and business practices of Mt. Gox, which at the time was the world’s largest Bitcoin exchange. According to coinmarketcap.com, from October 1 to November 30, 2013, the market capitalization ranged from $1.5 billion to $13.5 billion.

A dark web marketplace strongly emphasizes protecting its customers’ privacy while selling anything from narcotics to weapons. BTC, accessible through the Tor browser, was the most popular way for Silk Road users to make payments.

The FBI detained Ross Ulbricht, the man who founded Silk Road, on October 2, 2013, while logged into a public library server. It marked one of the initial laws for Bitcoin and gave it a bad reputation among the public. The cost decreased from approximately US$145 to US$109.

In the middle of 2010, Jed McCaleb launched Mt. Gox, the first exchange platform for exchanging Bitcoins. The exchange was later sold to Mark Karpeles, a French businessman operating in Japan. From a once-promising platform, it grew enormously in popularity and transaction volume. By the end of 2013, however, it was experiencing cash flow problems.

On February 24, 2014, the trading site abruptly stopped all activity, leaving users hanging while it shut down. Mt. Gox filed for bankruptcy a few days after that, on February 28. Over 850,000 BTC was allegedly stolen from its users by the company due to “technical issues.”

The Economist featured Bitcoin on its front page on October 31. Despite the flood of unfavorable opinions against digital currency, many corporations and household names gradually embraced Bitcoin. Microsoft started taking Bitcoin payments on December 11, 2014, a big step forward for bit coiners.

The most extensive bull run for cryptocurrencies and their introduction into the mainstream occurred at the beginning of the year. On March 10, 2017, the Winklevoss twins made news of their lawsuit against Facebook founder Mark Zuckerberg for the alleged theft of intellectual property that inspired the platform’s development.

The United States Securities and Exchange Commission rejected the twins’ proposal to start the Bitcoin Exchange-Traded Fund (ETF) (SEC). When scaling concerns affecting Bitcoin were being discussed and debated, Bitcoin surged over its all-time high of US$3000 on June 11 of that year.

Despite the growth of Bitcoin and other cryptocurrencies, scalability remains a barrier to widespread adoption. Prior to the Lightning Network, Bitcoin completed seven transactions per second, compared to Visa’s 24,000 transactions per second. As a result, their processing is slower, and their transaction costs are higher.

Lightning Network provides users with an effective shortcut. The system uses smart contracts based on blockchain technology to enable instant payments between users. A payment channel can be set up between any two parties present on this layer by extending the Bitcoin blockchain.

Bitcoin is often seen as a significant investment, but there are some potential hurdles on the way to the adoption of the digital currency:

The absence of regulatory control is among the most significant disadvantages of investing in Bitcoin. Laws and taxes relating to cryptocurrencies vary from nation to nation and are frequently unclear or controversial. Unfortunately, a lack of regulations might result in fraud and defrauding.

If a financial expenditure resulted in future cash inflows without the need to sell the asset, traditional investors would consider it an investment. For instance, one can produce cash flow by renting a home without selling the underlying asset. Similarly, if a shareholder purchases equity in the company, those shares provide cash flow in the form of dividends.

On the other hand, no cash flow is produced regarding cryptocurrency. The investor only stands to win if they can locate a buyer of the currency who is prepared to make a more excellent offer. Investors in cryptocurrencies are hence more susceptible to market whims.

The Bitcoin program is still in beta and is actively being developed with numerous unfinished features. To increase the security and usability of Bitcoin, new features, tools, and services are being created. Some of these still aren’t suitable for everybody.

While recognition had helped the first digital currency reach record highs, its regular volatility—on the whole show in early 2022 when prices plunged by over 50%—is the crypto coin’s primary obstacle.

During the second quarter of 2022, market uncertainty continued to have a significant negative impact on the world’s first digital currency, driving prices below US$20,000 for the first time since December 2020.

Through the beginning of September, Bitcoin prices fell, the remaining range bound at about US$19,000. Despite this significant price decline, Bitcoin’s powerful performance and future potential cannot be ignored.

The closest asset to cryptocurrencies in terms of growth has been gold, which has increased by just 627% over the past 100 years, rising from U.S. $283 in January 1921 to US$2,060 in August 2020.

Bitcoin is a limited supply, unlike conventional currencies that can expand their circulation by printing more. There are 21 million, of which 19,144,112 are in use. This leaves little under 2 million available for mining.

This limit, which is an essential component of the Bitcoin algorithm, counteracted inflation by ensuring scarcity.

When a Bitcoin miner completes a block of transaction verifications on the blockchain using specialized software, they produce a new Bitcoin. About 900 Bitcoins are mined daily; however, the Bitcoin protocol cuts the number of new coins released in half after the 210,000 blocks are finished.

ETH might be valued in 2022 between $6,500 and $7,500, according to the cryptocurrency news site Coinpedia, if the positive upswing that began in mid-2021 were to continue. Nevertheless, a bearish fall in the cryptocurrency market in 2022 showed that Ethereum’s price is unlikely to increase solely based on mood.

Bitcoin has been controversial since its inception, but it remains one of the most innovative financial technologies. With continued growth and adoption, Bitcoin may soon become the norm for global transactions. Since the inception of Bitcoin, the cryptocurrency industry has continued to grow. In reality, it is simple to see how cryptocurrencies are gradually spreading over the world. The acceptability and use cases for cryptocurrencies are growing as a result of the expanding trend. Even the development of a Central Bank Digital Currency (CBDC) is underway today, and prominent corporations are investing in cryptocurrencies and blockchain to demonstrate their growing interest in these technologies. Those kinds of things will undoubtedly drive the market’s rapid development. There are more and more Bitcoin ATMs, more businesses are taking cryptocurrencies as payment, crypto assets are being utilized for fundraisers, and you can even use cryptocurrencies for touring the world!

© 2025 by Speed1 INC.